| Sage Pay Go is an online payment service that is easy to integrate, simple to use and is extremely good value. It enables you to accept payments securely through your website, over the phone or via mail order.

If you are already a Sage 50, 200 or Instant Accounts customer, Sage Pay lets you take phone, online or mail order payments from within your Sage software.

Why Sage Pay Go?

Payment processing can be complex, but at Sage Pay we keep things simple, so that you can get on with running your business.

Gateway Services Pricing

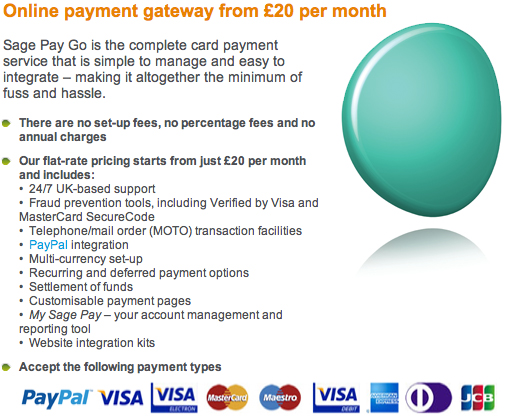

Our payment gateway connects to all the major UK Merchant Account Providers. We offer a simple sign up process combined with extremely competitive pricing. Sage Pay Go:

Up to 1,000 transactions a quarter - £20 per month.

Over 1,000 transactions a quarter - a maximum of 10p per transaction.

Also included in the Sage Pay Go package:

24/7 UK-based telephone and email support

Free fraud prevention tools, including 3D Secure

Free telephone/mail order (MOTO) facilities

Telephone and mail order (MOTO) integration with Sage 50, Sage 200 and Sage Instant Accounts

Free multi-currency set-up

Free recurring and deferred payment options

Free integration guides

Totally customisable payment pages

Sage Pay Go Bolt-ons

Because one size doesn't always fit all, we've designed some handy bolt-ons to enhance our standard Sage Pay Go.

Merchant services: we can help you with your merchant account and make accepting card payments more profitable.

Premium fraud prevention tools: if you're selling high-value goods or have been susceptible to fraud in the past, you can toughen up your fraud screening.

Priority support: when 24/7 support isn't enough, we can offer dedicated account management.

Is this right for me?

All major card schemes are supported.

Real-time or batch authorisation.

Delayed settlement, repeat and refund options.

Multi-currency payments.

Virtual Terminal included at no additional cost.

24/7 Customer Services.

Customisable payment pages.

Real-time reporting.

Fraud screening & risk management

Risk management has become a key component of payment processing solutions. All fraud checks are designed to prevent fraud before it takes place to avoid chargebacks.

Sage Pay complies with all the bank initiated fraud checks including: AVS, CV2 and 3D Secure (Verified by Visa and MasterCard SecureCode).

Sage Pay partners with risk management specialists, The 3rd Man.

Stable and robust infrastructure ensures maximum resilience.

System monitors and disaster recovery processes 24/7/365.

PCI DSS Level 1 compliant.

If you have any questions or need further information do not hesitate to contact our Customer Service Team 24hrs a day or visit the sage website.

www.sagepay.com |